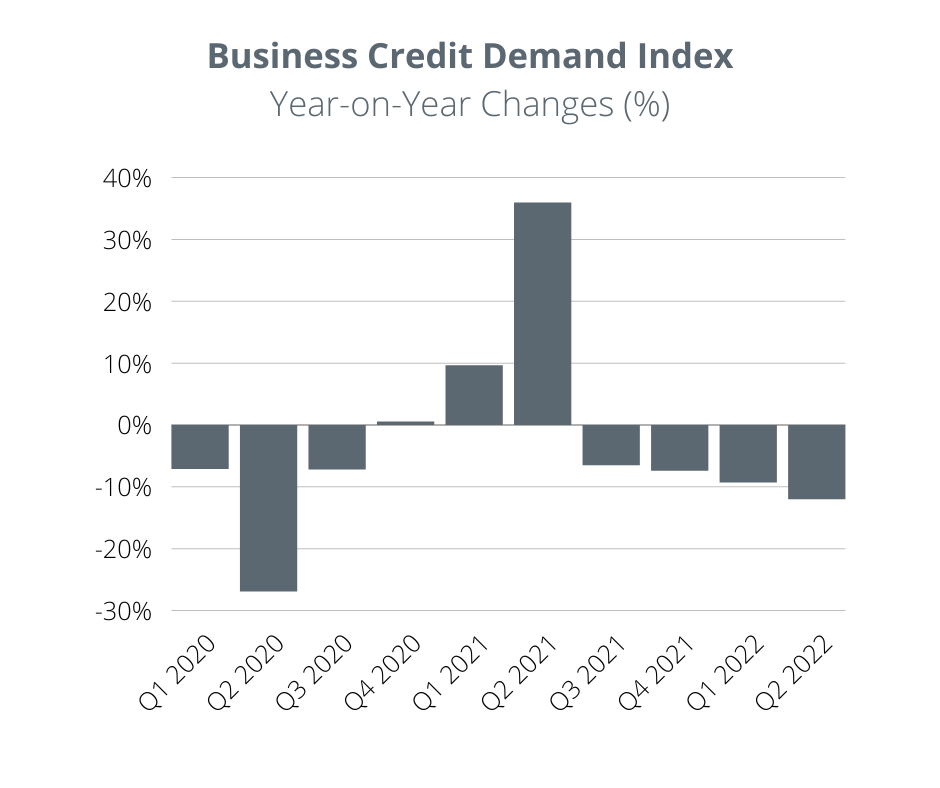

Business Credit Demand down 12% during the June 2022 quarter, Business Loans below 2020 lockdown levels

Equifax NZ Business Credit Demand Index: June Quarter 2022

-

Overall business credit enquiries down by -11.9% (vs June 2021 quarter)

-

Business loan enquiries decreased by -18.8% (vs June 2021 quarter)

-

Trade credit enquiries decreased by -9.0% (vs June 2021 quarter)

-

Asset finance enquiries down by -6.6% (vs June 2021 quarter)

Overall business credit demand is down year-on-year for the 4th consecutive quarter, and remains below pre-COVID volumes. Business credit demand fell by 11.9% in the June quarter, driven predominantly by business loans but there were declines in all major business credit demand categories

Business loans had the largest decline in commercial demand, with an 18.8% year-on-year fall for the quarter, when compared to the June quarter of 2021.

Released today by Equifax New Zealand a global data, analytics and technology company and the leading provider of credit information and analysis in New Zealand and Australia, the Business Credit Demand Index (BCDI) measures credit enquiry volumes for commercial products including asset finance, business loans and trade credit.

Equifax New Zealand Managing Director, Angus Luffman said, “With business confidence remaining at lows only seen for short periods of time, in the initial phases of the pandemic and around the GFC, the softness of business credit demand is to be expected.”

“The uncertainty created by rising interest rates, above target inflation and supply-chain constraints will be impacting business credit demand, but it is the labour supply shortfalls that likely have the greatest impact on investment plans. If businesses struggle to get access to the labour to implement their growth plans they will limit the capital they allocate and borrow.” Luffman continued.

The construction sector particularly felt the disruptive impacts of the current economic conditions, with business loan credit demand down 18.5% for the segment, in the June quarter. “There are multiple forces at play, with build delays arising from COVID, supply-chain constraints and staff sicknesses, all which impact critical stage payments. At the same time, construction consents are at record highs and well above industry capacity to execute.” Luffman said

Credit demand for asset finance and trade credit is currently stronger than business loan appetite, with year-on-year reductions for the quarter to June 2022 of 6.6% and 9%, respectively.

Asset finance and Trade Credit demand will feel the effects of economic headwinds, broad based credit demand has held up relatively well, with most of the June quarter decline driven from the Construction, Professional, Scientific and Technical Services sectors” Added Luffman.

NOTE TO EDITORS

For more information, please contact:

Serena Benson 022 077 0767 – [email protected]

ABOUT EQUIFAX INC.

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employees, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by more than 11,000 employees worldwide, Equifax operates or has investments in 25 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit www.equifax.co.nz or follow the company’s news on LinkedIn.

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting, or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.